Housing Construction

We analyzed 60 markets to look for great startup opportunities. We gathered size and amount invested to build opportunity scores, then considered falling input costs to pick a few top opportunities to highlight. One of the top opportunities we found was housing construction.

American housing construction is valued at $718B, but there are only 60 Series A teams building here. Housing is broadly defined to include everything from large-scale poured concrete high-rises to smaller homes (eg the Cover home pictured above.)

There are multiple ways new technologies could transform this market. America’s housing woes are often concentrated in urban areas. There, the design and build cost of custom floorplans using local labor drives high costs. New software algorithms could reduce design costs, and robotic manufacturing or assembly could reduce build costs. In the suburbs, more standardized layouts can work. Technologies like 3D printing, novel molding of concrete, robotic automation, and software-driven design could help lower costs.

Dropping Input Costs

Costs for engineering software that can go from blueprint to CAD files has dropped 10x in the last 15 years.

Costs for robotic automation have declined 6x over the last 20 years

Costs to 3D print concrete homes have declined at least 3x over the last 15 years.

Large Market

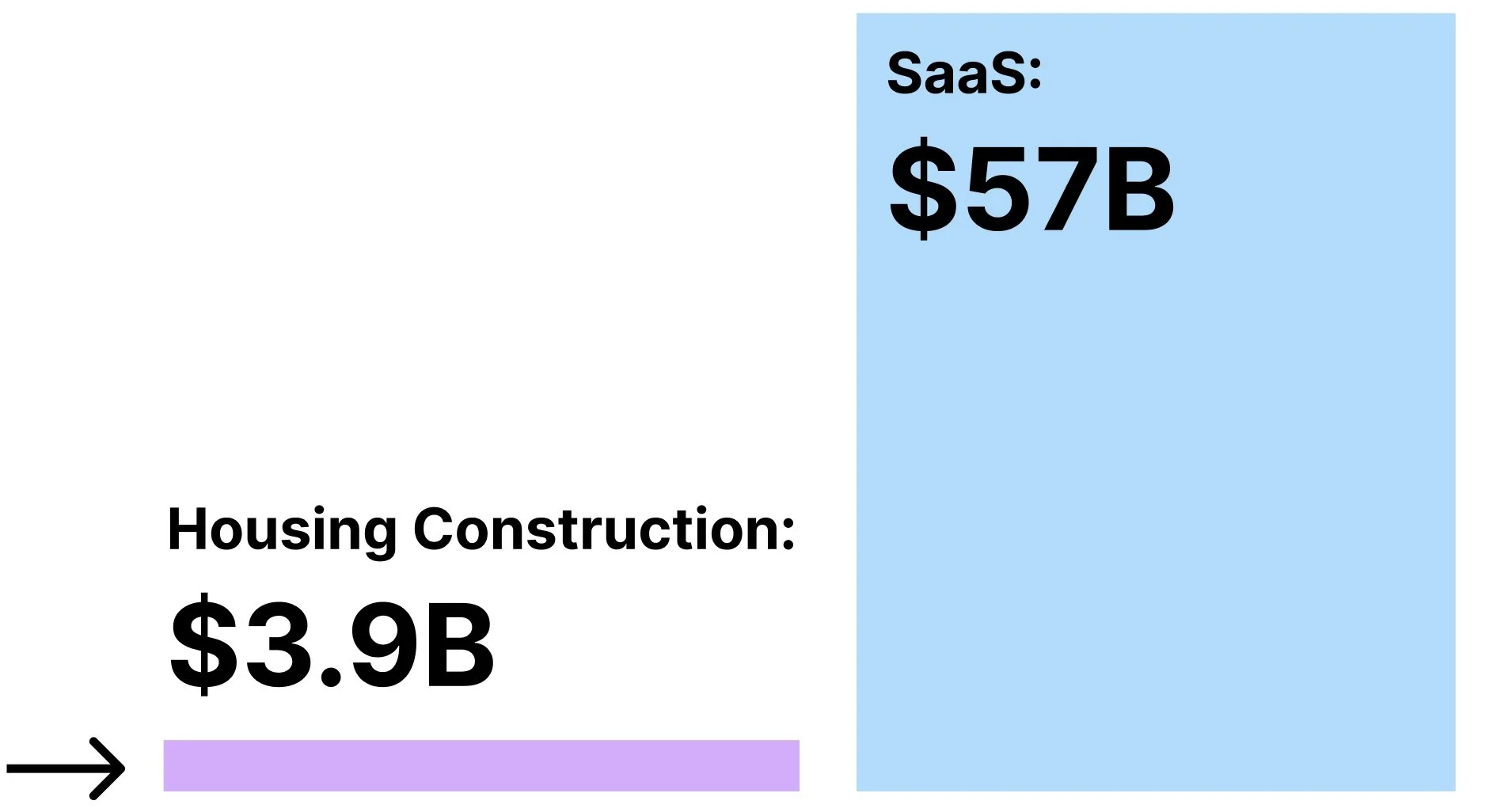

The U.S. housing construction market is significantly larger than the U.S. SaaS market. Yet in the last decade, there have only been 60 Series A home construction companies, while there have been over 1,200 in SaaS. And total funding has been far lower in housing.

Few Startup Competitors

We found 60 Series A startups in the U.S. housing construction space in the last 10 years. In total, they’ve raised $3.9B. Compare that to the U.S. SaaS market, where startups have raised $57B, roughly 14x more.